Advisers who are directly interacting with clients, and senior staff within a firm, need to fully embrace the Consumer Duty as the scope of the new rules, which are phased in from July 2023, is huge. There are four outcomes each firm is expected to monitor and evidence:

- Products and services

- Price and value

- Consumer understanding

- Consumer support

In this article, we look at the first of these – products and services – and how far away from the FCA’s expectations firms are now?

Elevation, a VouchedFor platform, has analysed over 250,000 prospect/client reviews to reveal how well firms are currently meeting the Consumer Duty ‘Products and Services’ outcome. The data shows that most advisers are doing a good job, but there are still opportunities to improve.

We’ve identified four top tips to help you address this outcome in your implementation plan.

1. Get to grips with client needs

Under the ‘Products and Services’ Outcome, distributors “must ensure the needs, characteristics and objectives of the target market are taken into account,” according to the FCA rules. So, advisers must uncover and document client motivations and objectives from the very start of the adviser-client relationship, beginning when clients are prospects.

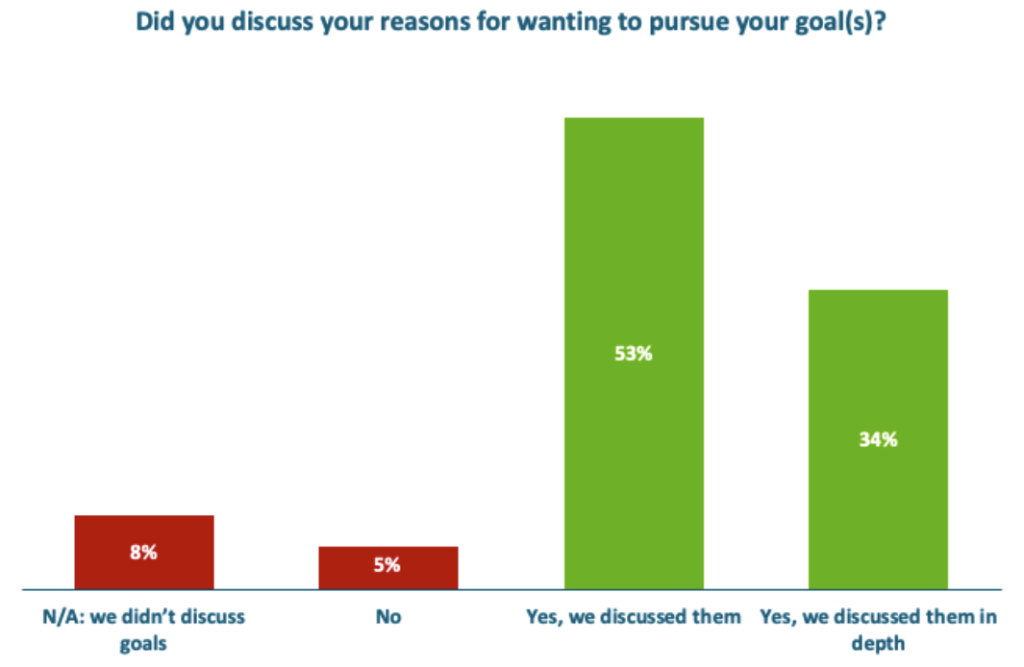

Nearly nine in 10 (87%) prospective clients said they did discuss their motivations for pursuing their goals with their adviser, according to Elevation data. This is positive. But there is considerable room for improvement, as just 34% of these prospective clients said they discussed their goals in depth.

A small minority (13%) said they did not discuss their goals or reasons for pursuing them, meaning these firms are unlikely to be compliant with the Consumer Duty regulations without making changes.

Helena Wardle, a Chartered Financial Planner and Director of Smith & Wardle, emphasises how emotional the subject of money is for many people, and encourages her clients to discuss their motivations, experiences and fears. “We really focus on trying to help the client be comfortable and we do this by making it clear the meeting is for their benefit not ours.” She also focuses on goals in the first meeting, by not asking how much money a client has.

2. Keep the conversation going

Ongoing conversations are an important part of Consumer Duty compliance. People may start with a specific motivation or goal, but these can easily change over time. So, it is no surprise that the FCA expects advisers to “carry out regular reviews to ensure their products/services continually meet the needs of the target market”.

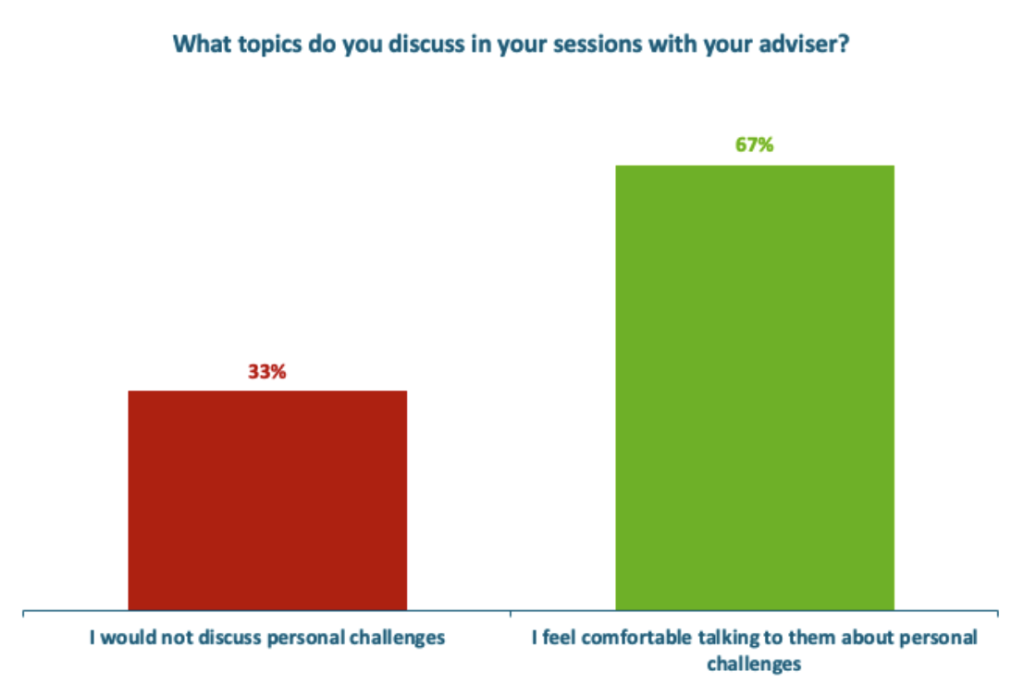

Even though advisers may speak to their clients regularly, they need to be sure that they put clients at ease and allow them to feel free to discuss any concerns they have. Yet one third of clients don’t feel comfortable discussing personal challenges with their adviser.

3. Ensure clients understand risk

Advisers must also be sure that clients understand the potential risks or disadvantages of their recommendations. The ‘Products and Services’ outcome also specifies that distribution arrangements “must avoid causing and, where that is not practical, mitigate foreseeable harm to customers”. All risks must be proportionate to the client’s objectives.

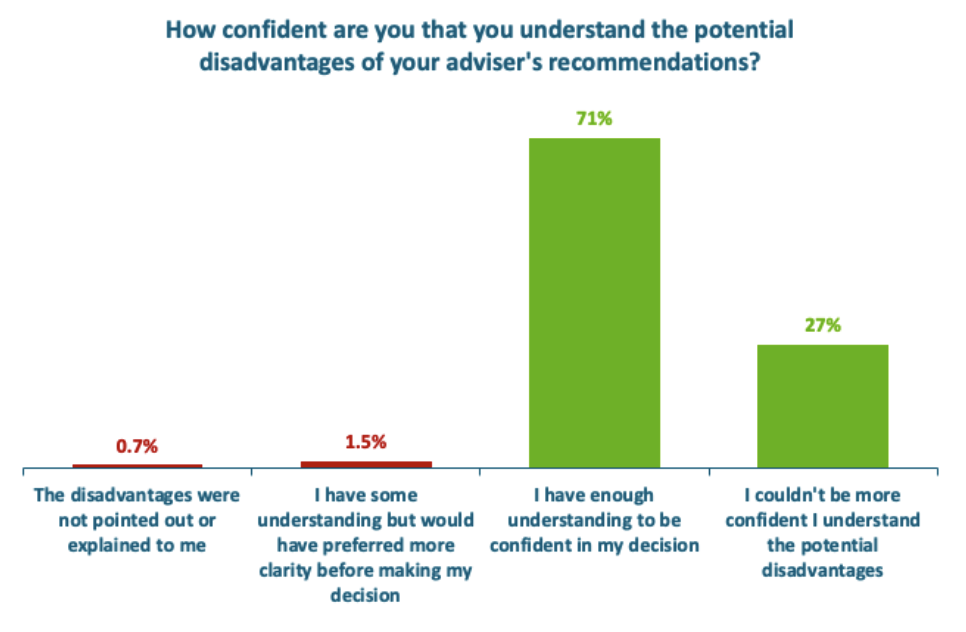

Advisers already seem to be doing well at this. Almost all clients (98%) were confident that they understood the potential disadvantages of their adviser’s recommendations, and approximately one quarter of these clients “couldn’t be more confident”, which would clearly meet or exceed the Consumer Duty requirements. Just 2.2% of clients said they didn’t have sufficient understanding, according to the Elevation data.

4. Conduct regular reviews

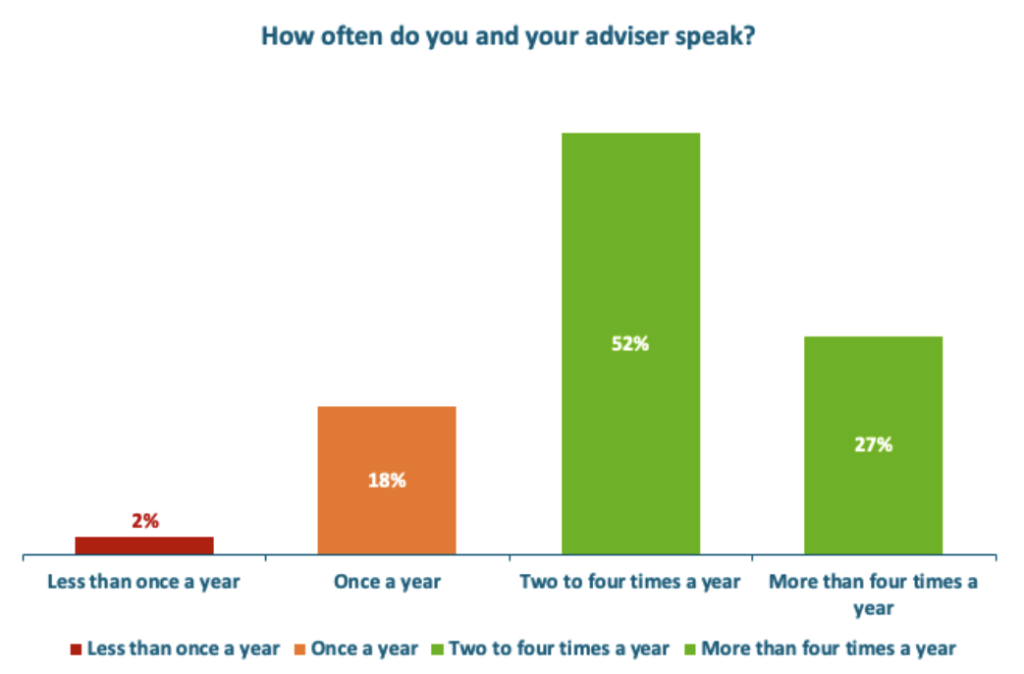

Ongoing reviews are happening, but are they happening often enough? The Elevation data shows that 27% of clients are meeting with their advisers at least four times a year, with 80% meeting at least twice a year. There is room for improvement, though, as one in five clients only speak with their adviser once a year or less.

The Elevation data suggests that most advisers are doing relatively well when it comes to future compliance with the Consumer Duty, but there is still work to be done. It is also vital that advisers continue to monitor their performance, so they keep improving.

Elevation, a VouchedFor platform, streamlines client feedback on behalf of advisers, and provides real-time and continuous analysis for constant insights and proactive identification of issues. To find out how Elevation can help you, see how your reviews stack up against the industry and if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk