Advisers have four ‘outcomes’ to consider under the FCA’s new Consumer Duty regulations: products and services, price and value, consumer understanding and consumer support.

This article looks at the second of these – ‘price and value’ – and the requirement of firms to “ensure clients are receiving fair value when it comes to the price of products and services”.

The FCA says fair value is two-fold:

- The product or service must meet the needs of the client.

- The product or service must be offered at a fair price.

The first of these is all about understanding clients’ needs, which we discuss here.

The second is about offering advice at a ‘fair price’. But how do you prove your advice offers value for money?

And can you demonstrate value at all if clients don’t really understand cost?

Through our Elevation platform, we’ve analysed over 250,000 prospect/client reviews to help firms understand and evidence the value they offer clients.

Fair value doesn’t need to mean cheap

The FCA says that “Firms [are required to] demonstrate that there remains a reasonable relationship between the total price of the product or service and the benefits the customer receives”.

It’s important that advisers don’t conflate the word ‘value’ with ‘cheap’. The Consumer Duty doesn’t pass judgement on a firm’s fees. Instead, it requires firms to ensure their fees are justified.

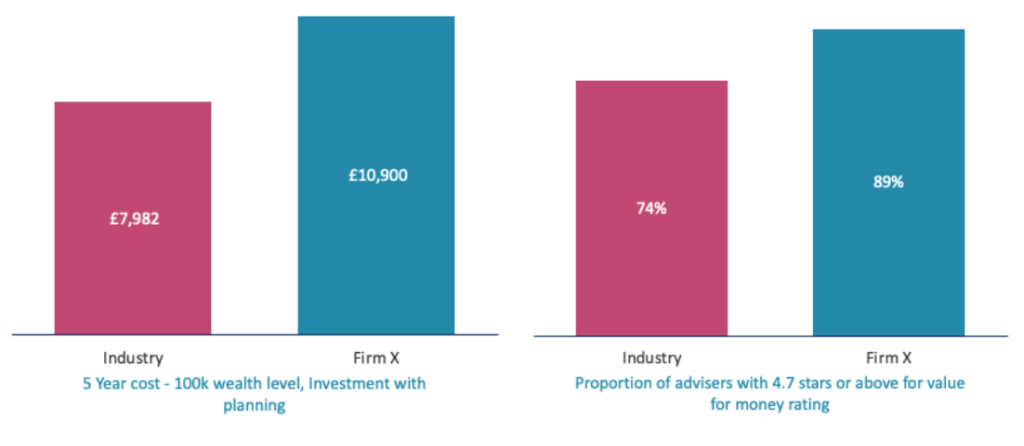

For example, the fees of one national advice firm on Elevation are 35% more than the industry average. On assets worth £100,000, over a five year period, the firm charges £10,900, vs £7,982 industry average.

However, even though the firm charges more for its advice than a typical firm, its ‘value for money’ score is also higher than the market average. Based on the data, 89% of their advisers are rated 4.7 stars out of five or better for ‘value for money’, compared to 74% of the market as a whole.

Understanding fees

Before firms can point the FCA to client feedback on ‘value for money’, they need to be confident that clients understand the fees they are paying for advice. After all, it is hard to judge value without knowing the cost.

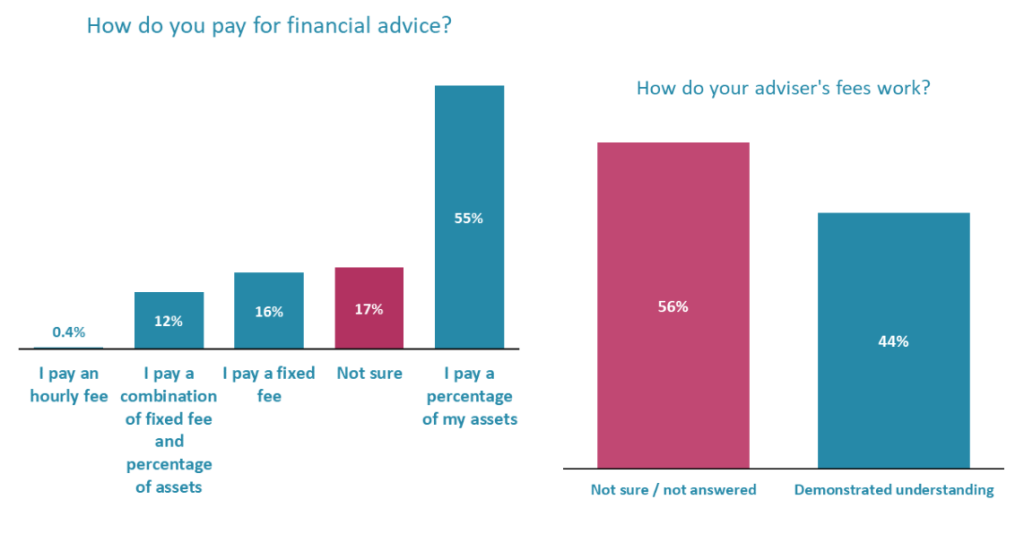

However, Elevation data found that one in six clients don’t know how they pay for their advice. This rises to one in two prospective clients.

This should ring an alarm bell for advisers. If they forget to clearly outline how their advice is paid for, they will fail to meet the requirements of this second part of the Consumer Duty. If advisers feel they have outlined their fees, it’s possible that their communications aren’t clear, or aren’t being read.

However, the issue is easily fixed, as it’s often a question of reminding clients regularly, and repeating information more than once.

Advisers who are apprehensive about giving their fees too much emphasis shouldn’t be: Elevation data shows that prospective clients who are clear about their adviser’s fees are over 40% more likely to convert than those who are not sure.

The importance of asking questions

Diligent advisers will no doubt be keen to check all their clients are clear on the fundamentals of their service. The most effective way to do this is to ask them. This will help to show the FCA that they’re compliant with this part of the Consumer Duty.

Firms could conduct customer research or use internal data to assess if a service offers fair value. Elevation goes further, giving firms adviser-level data, benchmarked against the industry, to monitor whether clients think they are getting fair value for the price they are paying.

Feedback from the Elevation platform can help show your firm and advisers how they benchmark against the industry and can help you evidence the value you’re providing to customers.

___________________________

Elevation, from VouchedFor, uses client feedback to drive business growth. Powered by 250,000 clients’ feedback, it identifies which factors make the biggest positive difference to client experience, and uses carefully engineered questions within a client survey to reveal how advice firms are tracking against them.

Elevation helps you drive advocacy from existing clients, improve conversion of prospective clients, and mitigate risk by identifying issues early.

To find out how Elevation can help you, or if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk