The third outcome of the Consumer Duty is ‘Consumer Understanding’, where firms are required to communicate in a way that, “in addition to being fair, clear and not misleading, is also understandable and facilitates informed consumer decisions”. In this article, we explain what this means and show where firms could strengthen their communications.

Advisers have four ‘outcomes’ to consider under the FCA’s new Consumer Duty regulations: products and services, price and value, consumer understanding and consumer support.

This article covers the third of these – ‘consumer understanding’ – which requires that any communication from advisers, “in addition to being fair, clear and not misleading, is also understandable and facilitates informed consumer decisions”.

So, what does this mean?

Put simply, existing regulation sets expectations for what firms communicate. The new Consumer Duty focuses on whether clients understand it.

Advisers shouldn’t assume that any client will engage with, and act on, generic information. This is especially important for clients in vulnerable circumstances.

Instead, communications should be tailored and targeted to meet different customer needs. But how do advisers understand whether their communications have hit the mark?

Elevation, a VouchedFor platform, gives firms answers to three key questions to show if they’re on track to meet the ‘consumer understanding’ outcome of the Consumer Duty:

1. Do clients read your communications?

2. Is your correspondence clear?

3. Have your clients understood it?

Do your customers read your communications?

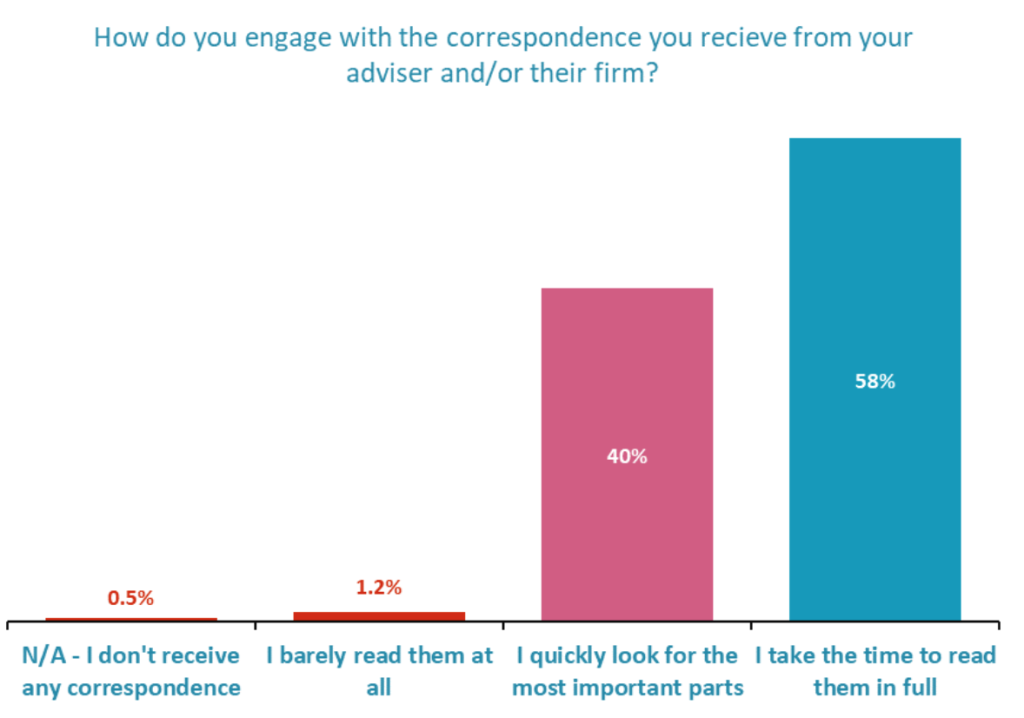

In reality, only a narrow majority of clients – three out of five – take the time to read correspondence from their advisers in full, Elevation shows. Two in five quickly skim read for the most important parts, while 12 in every thousand barely read written correspondence at all. Five in every thousand worryingly say they don’t receive written correspondence.

Firms may believe their documentation is ‘clear, fair and not misleading’, but not everyone is engaging with it as they might hope. Can a consumer really make an ‘informed decision’ if they’re only skim-reading ‘for the most important parts’?

Given the reluctance of customers to engage with written correspondence, advisers need to rethink how they present information. The FCA says that “firms should consider how the way in which information is presented…can help to improve or inhibit understanding”. If customers won’t or can’t engage with what you’re sending them, there is no way to meet the ‘consumer understanding’ outcome of the Consumer Duty.

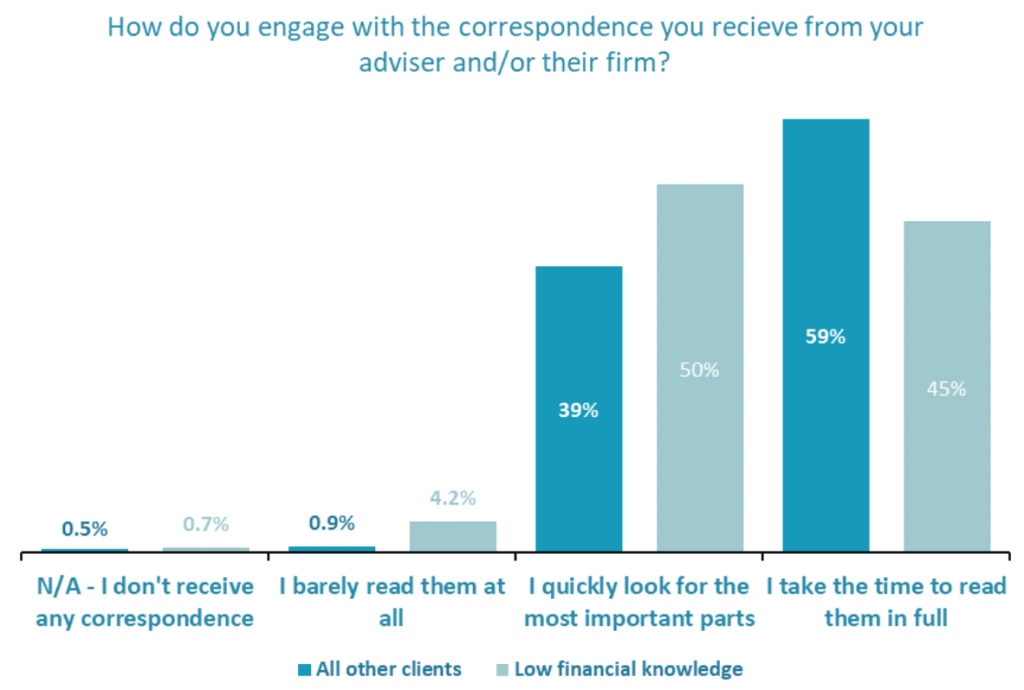

For customers in vulnerable circumstances, the importance of clear communication steps up a gear. Elevation data shows that clients with low financial knowledge are four times more likely not to read their adviser’s correspondence. Advisers should tailor communications to address the specific vulnerability characteristics of their clients.

Is your communication clear?

Communicating clearly is fundamental to good client service, but it is now also essential to demonstrate that your communications have been understood. Otherwise, you will fall short of the FCA’s Consumer Duty rules.

You need to measure the clarity of communication by identifying if clients understand the risk they are taking with recommended products, that they understand the fees they are paying, and that they are on track to meet their goals.

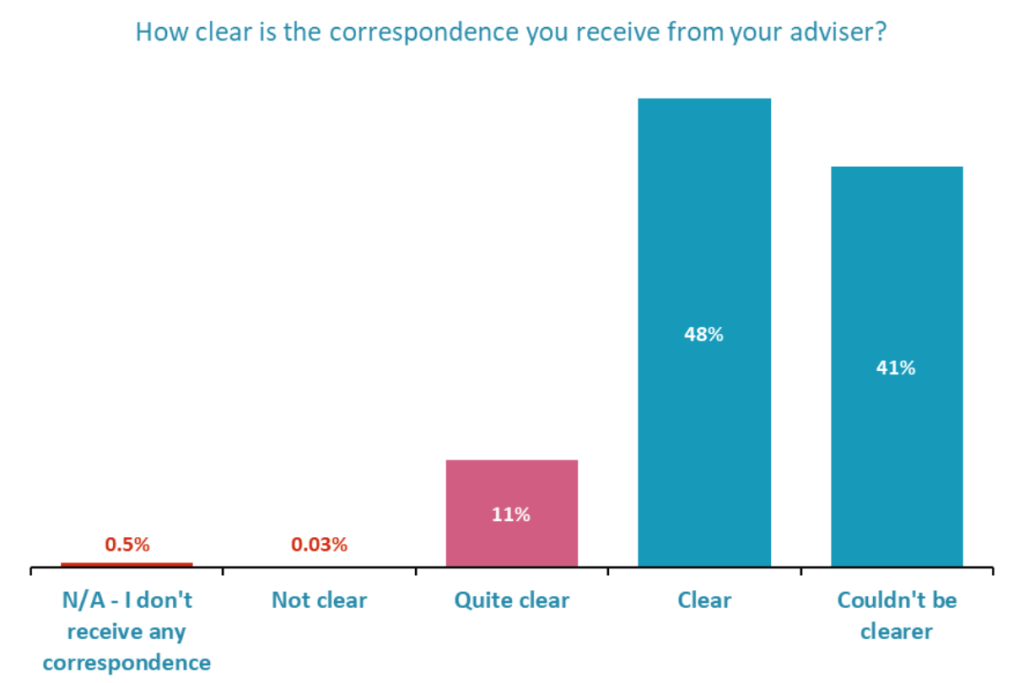

Elevation data is positive: most clients feel the communications they receive are clear.

Just over one in 10 show any hesitancy – that correspondence is ‘quite clear’. However, this rises to one in six for clients in vulnerable circumstances.

For all clients, there is significant risk in the outlying 1 in 100 clients who believe they don’t receive any correspondence at all or, if they do, feel it is not clear.

Have your clients understood your communications?

Monitoring understanding, and demonstrating it to the FCA, isn’t easy. This is where Elevation can help. In addition to monitoring client engagement with, and clarity of, your communications, Elevation highlights three specifics areas in depth:

1. Understanding of risk

2. Understanding of fees

3. Clients’ confidence of achieving goals

1. Does the client fully understand potential risk?

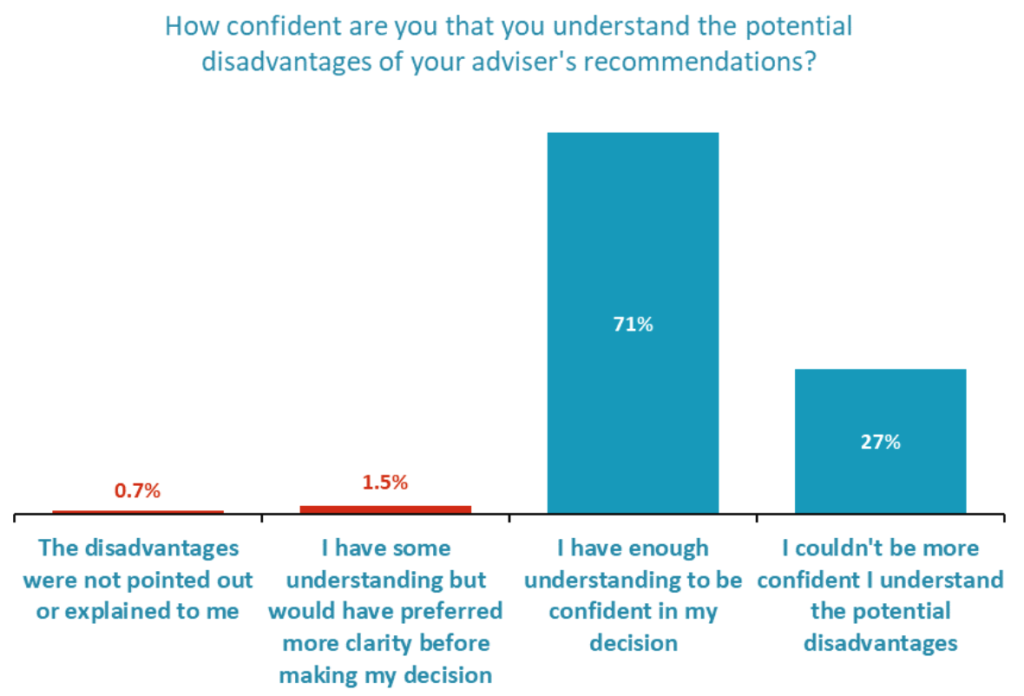

This is where there is some really good news, as nearly 98% of clients say they understand the potential risks or disadvantages of their adviser’s recommendations. Around a quarter of these clients say ‘they couldn’t be more confident’. However, 2.2% have insufficient understanding, and Elevation helps advisers identify these individuals to address the issue.

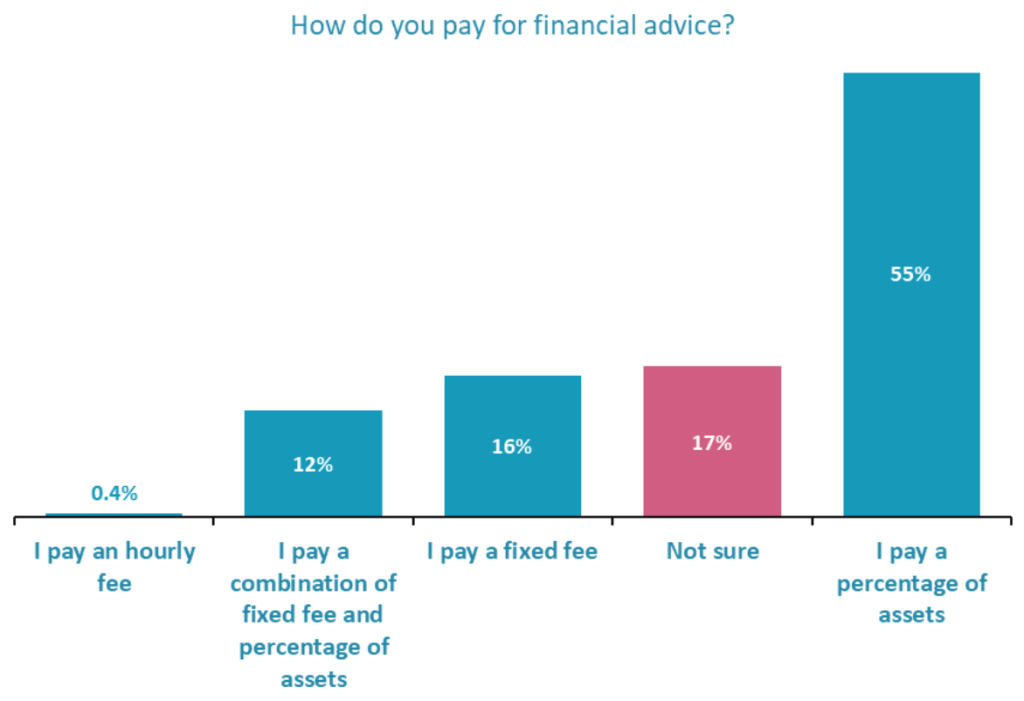

2. Does the client understand fees?

Here, Elevation data shows a significant opportunity for advice firms to rise to meet the Consumer Duty. One in six clients say they are not sure how they pay for advice. This falls short of the FCA’s expectations set out in the ‘Price and Value’ outcome.

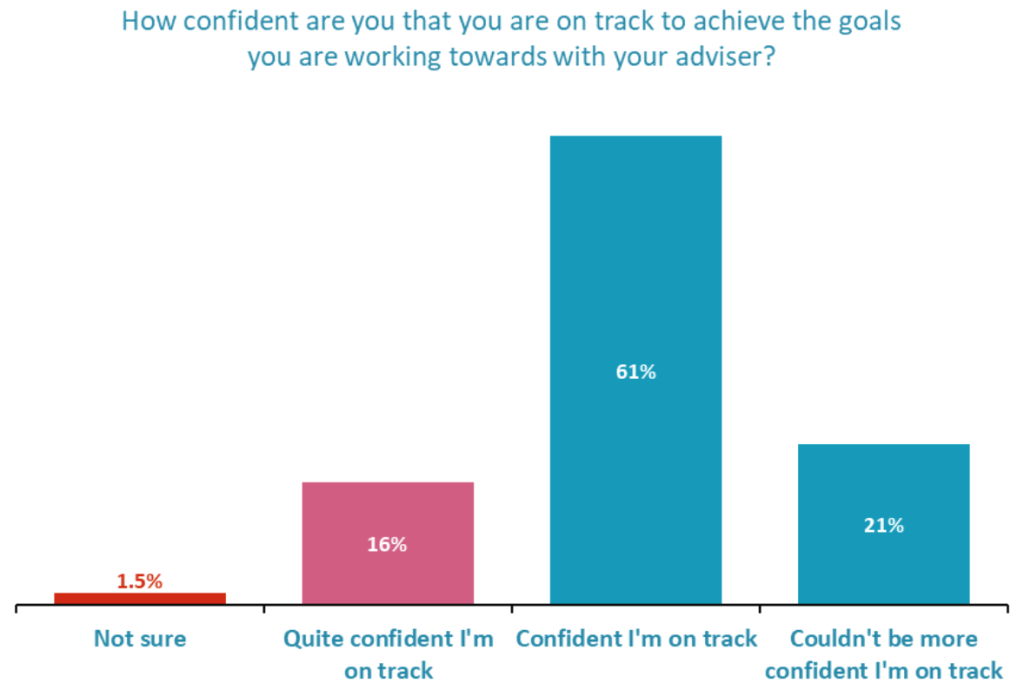

3. Does the client feel that they’re on track to achieving their goals?

The FCA says that ‘Firms must test, monitor and adapt communications to support understanding and good outcomes for customers’. Positively, Elevation data shows that four out of five clients feel confident they’re on track to achieving their goals, with one in five saying they ‘couldn’t be more confident’ they’re on track.

However, one in six clients said they were merely “quite confident”, and 15 in every thousand were unsure. These insights can help advisers adapt communications to improve these outcomes for customers and ensure they meet the Consumer Duty.

Are you conducting regular reviews?

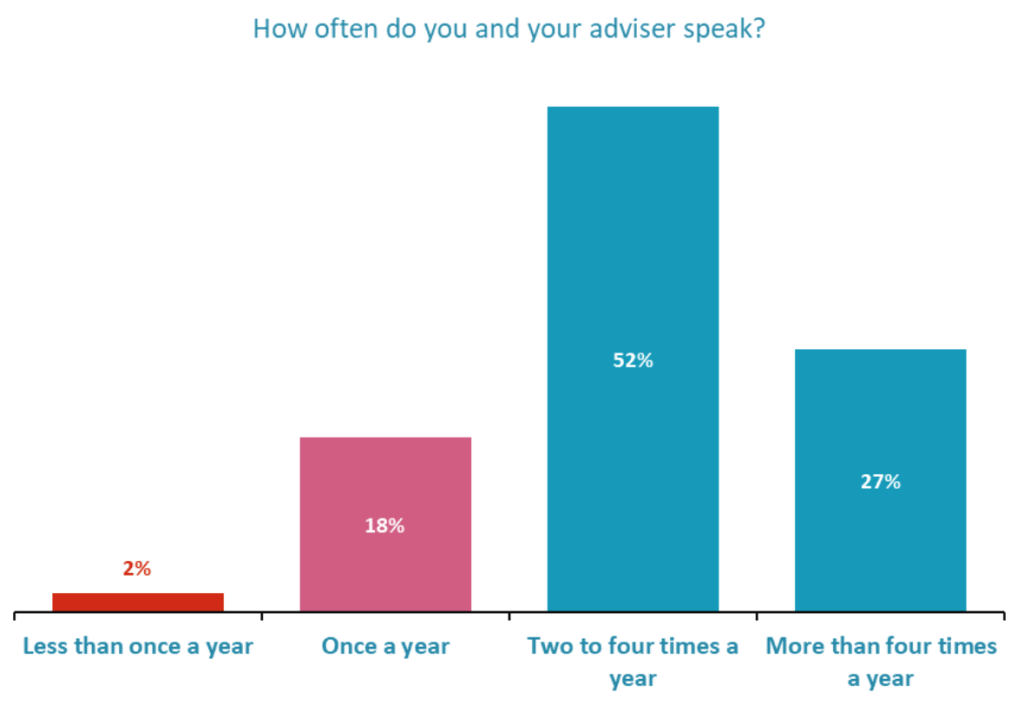

Communicating with clients more frequently is another way advisers can improve their clients’ understanding of the different elements outlined above. More frequent communication also benefits clients and advisers when it comes to the Product and Services and Customer Support outcomes aspect of the Consumer Duty.

Advisers should consider how, and how often, they communicate with clients, as one in five clients speak to their adviser just once a year or less. Depending on a client’s circumstances and needs, this may not be enough.

___________________________

Elevation, from VouchedFor, uses client feedback to drive business growth. Powered by 250,000 clients’ feedback, it identifies which factors make the biggest positive difference to client experience, and uses carefully engineered questions within a client survey to reveal how advice firms are tracking against them.

Elevation helps you drive advocacy from existing clients, improve conversion of prospective clients, and mitigate risk by identifying issues early. It can also form part of your ongoing response to the Consumer Duty.

To find out how Elevation can help you, or if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk