The fourth outcome of the Consumer Duty is ‘Consumer Support’. Firms are required to support clients all the way through their relationship so they can “consistently get the full benefit of the product and services they have purchased without unreasonable barriers”. In this article, we offer three simple steps firms can take to nail this part of the Consumer Duty.

Advisers have four ‘outcomes’ to consider under the FCA’s new Consumer Duty regulations: products and services, price and value, consumer understanding and consumer support.

This article, concluding our series on the four outcomes, looks at ‘consumer support’. The FCA requires that clients can get the full benefit of products and services they have bought, throughout their relationship, without unreasonable barriers.

So, what does this mean?

According to FCA research, customer support typically declines after a client has bought a product. So, this part of the Consumer Duty is designed to ensure clients are not forgotten after they have signed on the dotted line. Instead, advisers are expected to maintain – and show they have maintained – the same level of client support throughout their entire relationship.

Elevation has analysed over 250,000 clients’ feedback to identify three simple proof-points for advice firms to show how they’re rising to meet the ‘consumer understanding’ outcome of the Consumer Duty.

1. Be accessible to clients

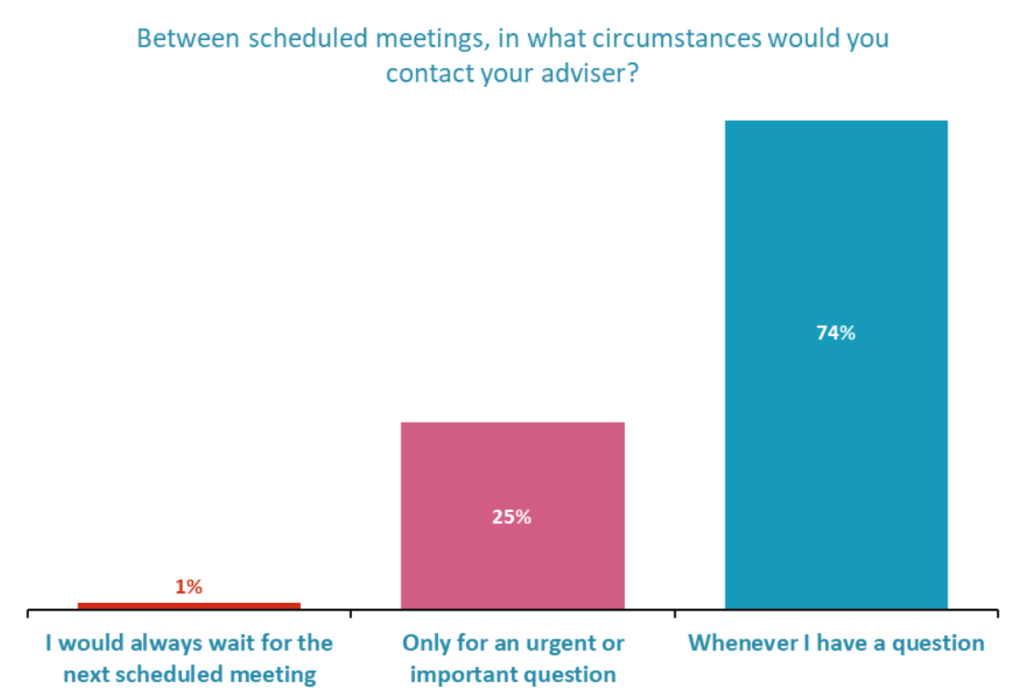

One of the ways advisers can demonstrate they are providing a consistent level of support to all their clients is by showing that customers have access to their adviser ‘without undue hindrance’. To help, Elevation asks clients how comfortable they feel contacting their adviser between scheduled meetings.

The data is positive, with three in four clients saying they contact their adviser whenever they have a question. Perhaps this is unsurprising, as many advisers have a strong personal relationship with their clients. But there is still an opportunity here, as one in four clients remain hesitant to reach out to their adviser proactively.

Advisers could address this by communicating regularly with clients, such as by newsletters or emails, and inviting clients to get in touch with questions. They could also offer clients a breadth of channels to contact them on, including a client portal, or even SMS or WhatsApp.

2. Identify clients who need extra support

The FCA makes it clear that a ‘one-size-fits-all’ approach is not sufficient. Firms should identify clients who need different levels of support. For example, when they are “dealing with non-standard issues, and customers with characteristics of vulnerability”.

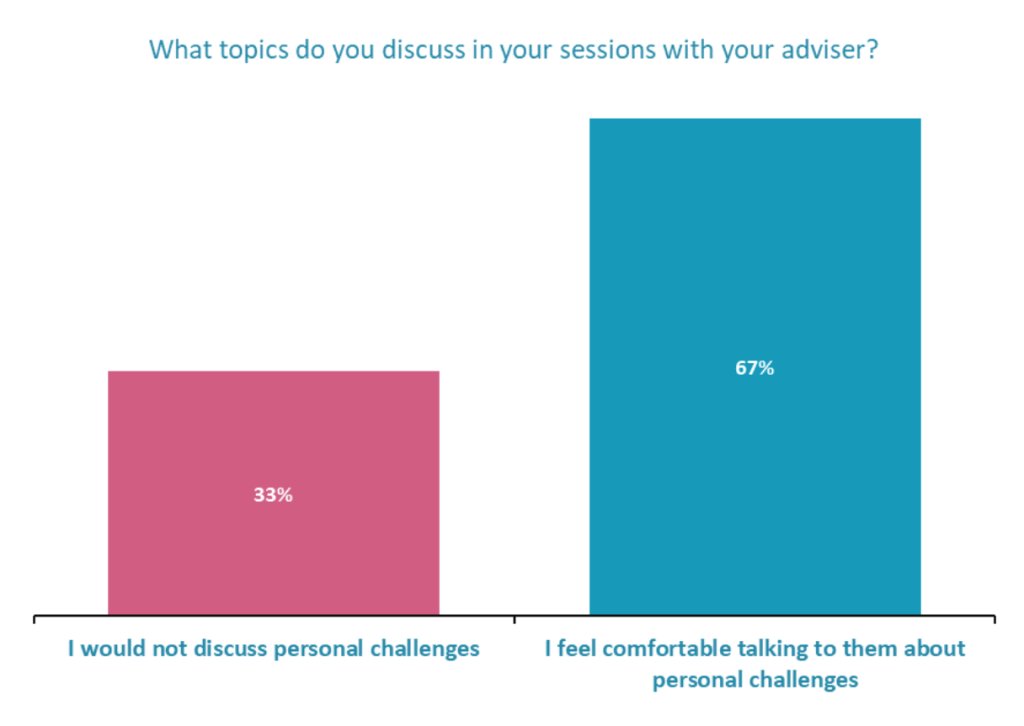

The onus is on the firm (rather than the client) to consider where vulnerability issues might arise. This might include a client experiencing relationship difficulties, bereavement, or health issues, or with a lower understanding of financial information. Elevation data uses a combination of different data points to identify clients in vulnerable circumstances, including a client’s level of financial knowledge and whether they received advice about long-term care.

The good news from the Elevation data is that two thirds of clients feel comfortable talking to their adviser about personal challenges; without this, it is hard to identify vulnerability. The opportunity for improvement with the remaining third is clear. In the first article in this series, we showed that regular conversations with clients are essential to make sure they are offered the right product or service for them. Speaking regularly also helps advisers identify characteristics of vulnerability that may apply to their clients

3. Confidence in service

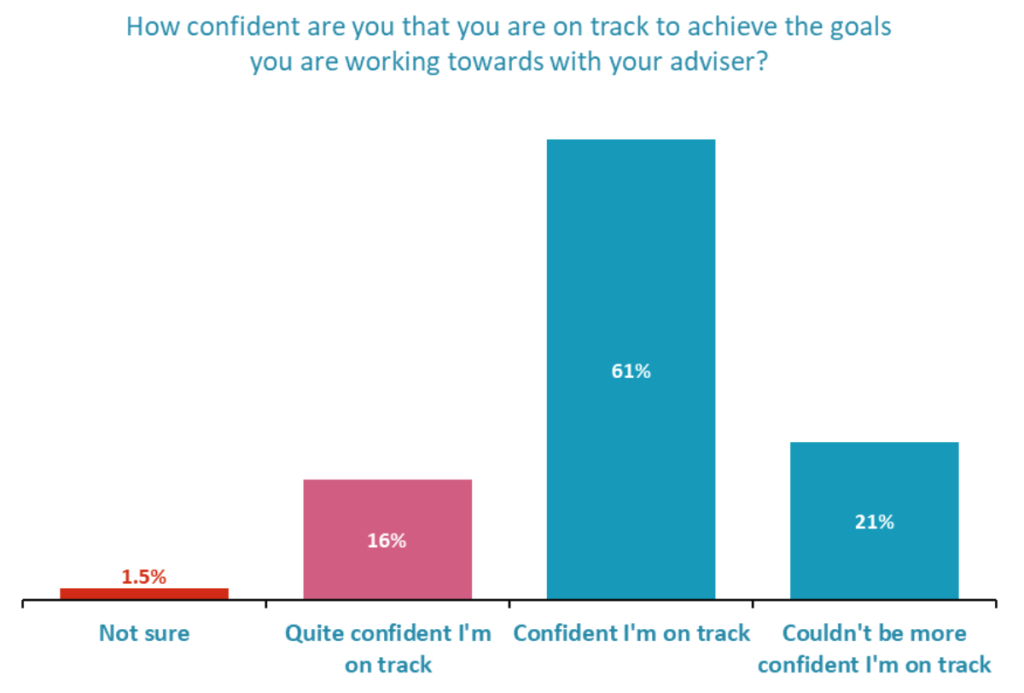

The third proof-point for firms to show the FCA that they’re meeting the Consumer Duty is that clients have confidence in the service they receive. The FCA requires firms to “regularly monitor whether they are providing an appropriate standard of support that meets the needs of retail customers’. Elevation asks clients if they feel they’re on track to achieve their goals.

One in five clients (21%) say they “couldn’t be more confident” they are on track to meet their goals. That means four in five clients (79%) could be more confident than they are. Asking this question regularly – and following up with those clients who are less than totally confident – can help to identify when clients’ needs (and their goals) have changed over time.

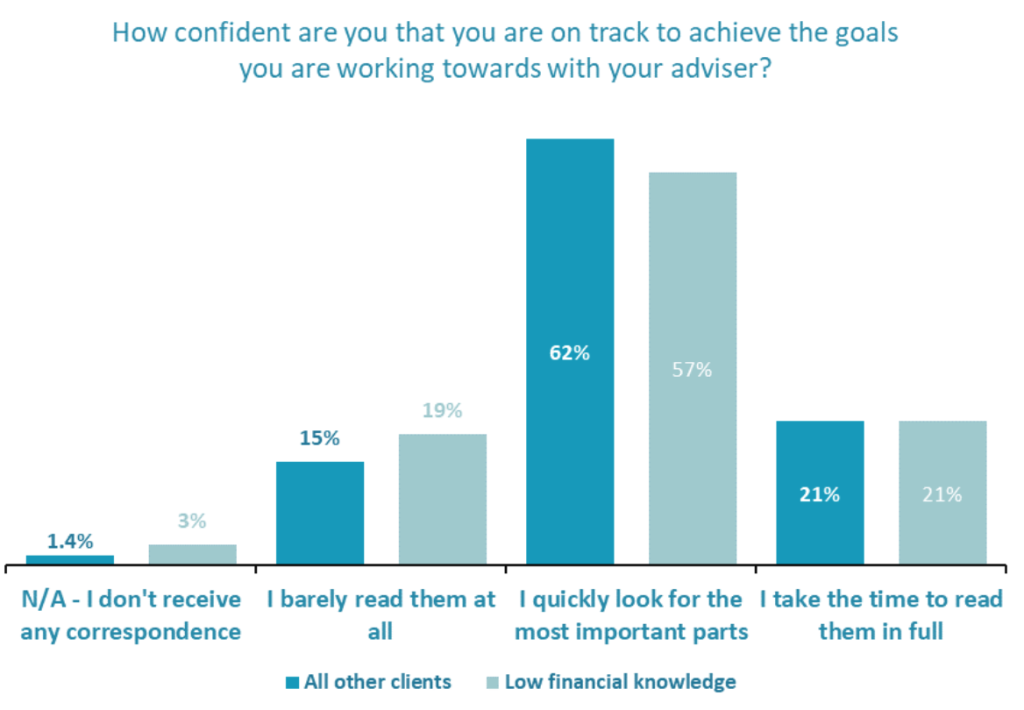

This is particularly important with clients who have a lower level of financial knowledge, which the FCA identifies as a characteristic of vulnerability. Elevation data shows that these clients are less likely to feel confident they are on track to reach their goals.

Where 61% of all clients feel confident they’re on track to meet their goals, this figure falls to 57% for clients with low financial knowledge. Twice as many of these more vulnerable clients aren’t sure whether they’re on track, compared to the industry average.

So, to recap: the FCA requires that clients can get the full benefit of products and services they have bought, throughout their relationship, without unreasonable barriers. Advice firms can show they’re on the case by being accessible to clients, identifying – and catering to – clients with specific needs, and monitoring their clients’ confidence in achieving their goals.

___________________________

Elevation, from VouchedFor, uses client feedback to drive business growth. Powered by 250,000 clients’ feedback, it identifies which factors make the biggest positive difference to client experience, and uses carefully engineered questions within a client survey to reveal how advice firms are tracking against them.

Elevation helps you drive advocacy from existing clients, improve conversion of prospective clients, and mitigate risk by identifying issues early. It can also form part of your ongoing response to the Consumer Duty.

To find out how Elevation can help you, or if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk